Manulife Philippines is accelerating its digitalization efforts to meet the rising demand for insurance and investment services in response to the dynamic shift in Filipino consumer behavior towards digital solutions.

A recent Manulife study showed that the Filipino home has become an all-in-one hub for digital activities. In fact, 82% of Filipinos surveyed utilize finance apps for cashless payments or to purchase insurance and investments, reflecting a growing awareness of the convenience and security that digital financial platforms offer.

Simplified and more intuitive insurance processes

Manulife Philippines has introduced a suite of digital services designed to simplify insurance purchasing and claims processing for their customers. Leveraging platforms such as Manulife Online, voted as the #1 self-service online platform in the insurance industry and its mobile version, the Manulife Online Mobile app, available on the App Store and Google Play; and Manulife Shop, its digital platform that allows Filipinos to purchase affordable insurance products online at their own convenience, the company aims to make insurance more accessible, simplified, and relevant for the modern Filipinos.

These initiatives support Manulife’s existing efforts to fully digitalize its customer journey, helping them learn about insurance products and customizing them based on their individual goals, so they can understand more complex insurance products and their suitability for personal financial goals.

Ivan Buenaventura, Chief Information Officer, Manulife Philippines, shared: “Grounded by our commitment to becoming our industry’s most digital, customer-centric global company, our digital services at Manulife are focused on addressing the most common pain points related to insurance, such as information access, financial literacy, affordability, and ease of use. We believe that with our continuous efforts at digital transformation, we are making insurance more accessible, intuitive, inclusive, and convenient, providing our customers the best experience and guidance they deserve.”

Sound financial planning amid enhanced investment opportunities in the digital age

According to Paul Lu, Head of Wealth Solutions, Manulife Investment Management Philippines, the company has been attracting a growing number of investors in its diverse range of unit investment trust funds (UITFs), especially among Filipino millennials and Gen Zs. “Since the onset of the pandemic, the total number of our millennial and Gen Z clients has more than doubled, accounting for more than half of our client base. Based on our study, the pandemic fast-tracked their financial transformation, particularly because some of them lost their jobs or experienced reductions in their total family income as a result of the economic disruptions. This caused shifts in their behavior that emphasize the importance of saving, investing, and prioritizing necessities.”

However, Lu is quick to note that first-time investors must start with a sound financial plan with clear investment goals and a thorough assessment of their risk appetite. “It is tempting to jump headfirst into the world of investing, but having a plan that is aligned with your investment goals and risk appetite will help you make more informed investment decisions and enable you to take full advantage of different investment options. This can be done with a trusted financial professional who can personally guide you,” Lu said.

Manulife Investment Management Philippines empowers investors to begin their investment journey by providing them affordable access to its distinctive selection of UITFs via Manulife iFUNDS, its easy-to-use and secure digital investment platform. The company’s certified UITF salespersons can help facilitate investors’ choices considering their unique goals, needs and risk appetites.

Online platforms have been instrumental in broadening financial awareness on reliable investment strategies such as long-term investments and diversification. Against this backdrop, Manulife Investment Management Philippines has made it easy for investors to diversify their investments through its UITFs that invest in both local and global securities. Through Manulife iFUNDS, investors can explore different investment options, schedule regular investments or top-ups via the Regular Savings Plan (RSP), and manage their UITF investments on-the-go with a few taps.

“While there is a perception that young Filipinos are chasing the fastest returns, we are more hopeful on the improving trends seen in investor education. Our study revealed that many Filipino millennials and Gen Zs are keen to learn more about investing, giving us the opportunity to educate them further on the important role that UITFs can serve in creating a sound financial plan even during periods of high market volatility. Although market volatility is an inherent element of financial markets, history shows that investing regularly can potentially reap better results over time. Moreover, there are investment options available for investors who prefer a stable holding facility for their surplus cash while planning for their next move,” Lu added.

Investors can invest in Manulife Investment Management Philippines’ UITFs for as low as PHP1,000 or USD100 via Manulife iFUNDS.

Empowering employees and financial advisors with digital tools

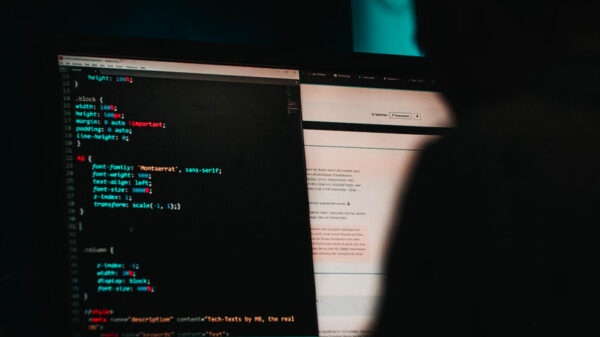

To further empower Manulife’s teams in embracing digital transformation to help achieve its business goals, the company has also continued accelerating its Drive to Cloud initiative, a comprehensive digital transformation project that targets migration of all its corporate technology assets to the cloud by end of 2024. The initiative prioritizes quicker time-to-market, scalability, increased reliability, enhanced performance, and operational cost-efficiency. This will help strengthen the company’s security and possible disruptions, risks, and cyberthreats brought by future innovations by ensuring preparedness and risk mitigation. Integrating AI-powered employee enablement tools in its daily functions, Manulife aims to further explore ways on how to boost efficiency and productivity as well as streamline overall operations.

“We stay at the forefront of technological advancements such as AI, cloud computing, and mobile technologies to enable our distribution teams in their sales activities,” Buenaventura added. “These technologies serve as great partners to equip and empower our agency force to thrive and stay true to our commitment to customers amid a fast-paced business environment and hyper-digitalized market.”

The continuous enhancements of its established platforms like the Electronic Point of Sale System (ePOS), an agent digital portal, a sales performance and activity tracking tool, and customer needs analysis tools also provide its financial advisors with centralized platforms that help them engage with customers better, understand their needs, propose tailor-fit solutions, optimize strategies, and facilitate sales with much ease and convenience.

Amid these initiatives, Manulife Philippines’ cybersecurity teams are also proactively addressing threats through regular training, security assessments, and application testing to ensure the safety of customer data.