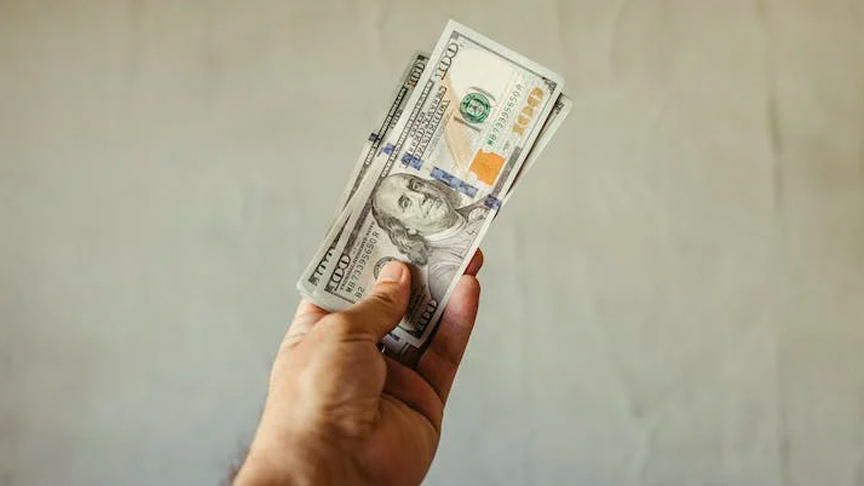

WorldRemit announced the results of its third Global Cost of Living Index. The year-on-year study assesses how the cost of living crisis is affecting financial decisions, including those of remittance senders who regularly send money home to support their loved ones.

Results show 73% of respondents in the US, 70% in the UK, and 78% in Australia reported an increase in the daily cost of living and globally, 81% said they felt utility costs increased in recent months. Housing costs continue to be impacted with 72% of respondents reporting an upswing in mortgage and rent payments, while 46% of respondents noted an increase in education and 74% in transportation.

One billion people worldwide – approximately one in eight – depend on remittances. As per WorldRemit’s 2023 Cost of Living Index, remittances sent to family and friends remain the main reason for money transfers (85%), with nearly a third (30%) of participants expressing a strong inclination to solely send money to their closest family members.

One in ten remittance senders are feeling heightened pressure to send money home. Against this backdrop, the number of respondents who reported an increase in the cost of living for those they send money to grew by 73% since the start of 2023. 54% of respondents reported going out less and trying to cook more at home; 47% said they are actively finding ways to save more money on their own day to day expenses; and 31% reported no longer going out for social gatherings to save money.

“As international money senders report rising living costs both for themselves and their families, they are increasingly making the tough decision between supporting themselves and supporting their loved ones back home. Receivers rely on the hard-earned money delivered by remitters for vital things like day-to-day expenses (such as food, transportation and clothing), healthcare and educational support,” said Mark Lenhard, Group CEO, Zepz.

“Our data shows that as the cost of living crisis looms, many are making sacrifices in order to continue to provide that support to billions across the globe.”

The multi-country study was fielded in July 2023 to determine the ongoing effects of the increased cost of living on international money senders in the United States, United Kingdom, and Australia, resulting in observations from 3,000 international remittance senders. WorldRemit’s 2022 Cost of Living survey can be found here.