OwnBank, the newest mobile banking app in the country, teams up with Mastercard to serve customers with enhanced banking convenience, more rewarding card offers, and secure digital transactions. This strategic partnership aims to foster financial inclusion and is poised to introduce new and sophisticated solutions that empower individuals and businesses across the country.

Despite cash being the primary payment method for Filipinos, authorities are urging an increased adoption of banking and debit cards, especially among the unbanked, to enhance financial inclusion. The country has witnessed a surge in digital-only banks and a preference for electronic payments, driving growth in card payments. According to a GlobalData study, the country’s cards and payments market was valued at over $45 billion last year, with an expected CAGR surpassing 7 percent from 2023 to 2027.

OwnBank and Mastercard join forces to create a seamless banking experience for Filipinos. Combining OwnBank’s commitment to financial inclusion and Mastercard’s global payment expertise, the collaboration offers Filipinos expanded digital payment options, global transaction acceptance, enhanced security measures, integrated app features, and more.

Start the year right with OwnBank and Mastercard

OwnBank and Mastercard’s collaboration expands digital payment options, enabling customers to access a wider array of digital financing solutions with Mastercard’s technology for secure, efficient, and convenient online transactions.

OwnBank through Mastercard will provide its users access to numerous international merchants and ATMs, thereby increasing transactional flexibility and convenience. OwnBank’s existing services will be integrated with Mastercard’s digital solutions, offering customers a comprehensive suite of financial services for managing transactions, transferring funds, and growing savings, all within a unified and streamlined banking environment.

Revolutionizing the debit card experience for Filipinos

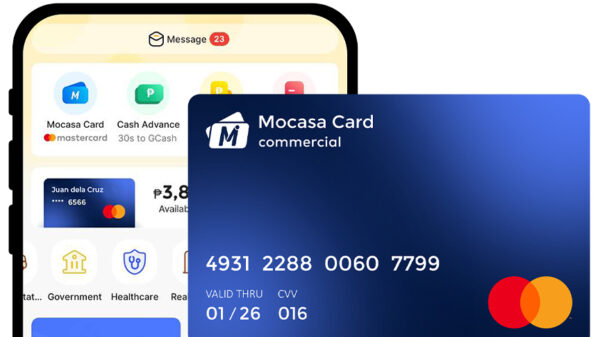

OwnBank, in partnership with Mastercard, is launching a virtual and physical debit card that offers its users an enhanced debit card experience with unparalleled flexibility. The features of the OwnBank debit card include:

● Free Debit Card: All OwnBank users will receive a virtual debit card. Furthermore, users who have fully upgraded their OwnBank accounts and met certain criteria are eligible for a free physical debit card, which will be conveniently delivered to their doorstep.

● Contactless Payment and Enhanced Security: The card features convenient contactless payment options and enhanced security with advanced EMV technology.

● Security Features: OwnBank offers a suite of options for enhanced control and security. Users can freeze their card, set transaction limits, and reset their card PIN directly through the OwnBank app.

● Unified Card and Account Number: The OwnBank Debit Card uniquely combines the user’s card number and bank account number, simplifying financial management and transactions.

● Personalized Payment Experience: OwnBank allows users to personalize their payment experience with editable payment settings and card number customization. This enables users to tailor their money management according to their preferences.

Upcoming features and promotions

The OwnBank Virtual Debit Card is set to launch in the first quarter (Q1) of 2024, followed by the Physical Debit Card in the second quarter (Q2) of 2024. Stay tuned for an array of exciting features and exclusive promotions from OwnBank, including unique functionalities of the upcoming debit card and irresistible deals and offers.

OwnBank recently launched in the local banking scene in October 2023 as the one-stop destination for Filipinos in search of an all-encompassing and more rewarding mobile banking service. It is BSP-regulated and PDIC-insured for banking with peace of mind.

Catch the latest updates from OwnBank. Download the app today on App Store, Google Play Store, or Huawei AppGallery to elevate your mobile banking experience.