The Palawan Group of Companies, a trusted leader in pawning and financial services, has strengthened its partnership with Small Business Corporation (SB Corp.) to enhance payment solutions for micro-, small, and medium enterprises (MSMEs) across the Philippines.

Established in 1991 under RA No. 6977 and subsequently amended by RA 8289 in 1997, SB Corp. operates under the Small and Medium Enterprise Development and Council of the Department of Trade and Industry. Dedicated to facilitating access to finance for MSMEs, SB Corp. offers a range of programs, including wholesale lending to smaller financial institutions, cooperatives, and foundations and retail or direct lending to MSMEs.

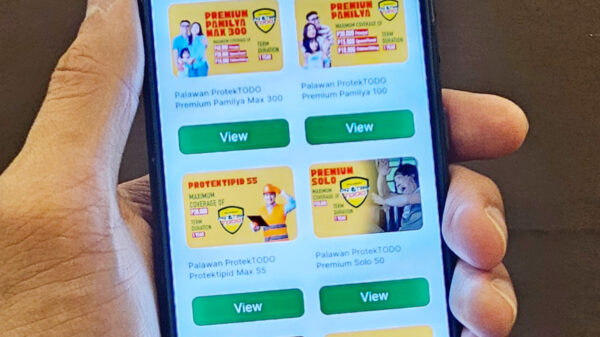

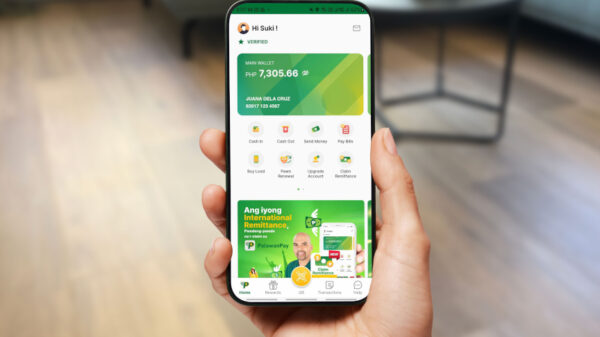

The partnership between Palawan Group of Companies and SB Corp. started in 2019, leveraging on the extensive network of over 3,300 Palawan Pawnshop – Palawan Express Pera Padala branches as the primary payment channels for SB Corp. clients, ensuring accessibility for borrowers. This collaboration has been enhanced with the integration of the PalawanPay app as an additional payment platform. SB Corp.’s clients can now make payments anytime, anywhere through this seamless integration, providing them with flexible payment options. This initiative provides greater convenience and accessibility for MSMEs across the Philippines.

Through the expansive nationwide network and innovative payment solutions provided by the Palawan Group of Companies, SB Corp. reinforces its commitment to empowering MSMEs and working together to promote financial inclusivity throughout the Philippines. Together, they strive to create a more accessible and conducive environment for the growth and success of small businesses, driving economic progress and prosperity across the nation.