The Philippines has already logged over 1.4 million cases of COVID-19 in the country, and daily records are still in the high thousands. With new variants being detected in the past months, Filipinos are called to take all necessary precautions not only for their health, but also for the unexpected financial burden it will impose on families. Preacher and well-known financial advisor Bo Sanchez knows first-hand the toll medical expenses could take when he caught the virus earlier this year.

“During good times, it’s easy to pretend that we’re okay financially, because money flows easily and major financial mistakes are covered up by good cash flow. But crisis is brutal – it separates the wise from the foolish. When money stops flowing, we realize how ill-prepared we are to meet our needs,” Sanchez, now recovered, stated.

Sanchez shared in one of his vlogs the financial challenges he encountered when he was sick. While he was able to save on massive fees by receiving treatment from his own home and using a secondhand oxygen concentrator, costs for medicine and other necessities still continued to pile up.

Sanchez actually came from humble beginnings – living with only PHP 800 a month as his missionary allowance. Through thoughtful planning and making the right financial decisions, he has built income streams and improved his financial capacity to be a more effective entrepreneur and preacher, a method he openly shares with the public as a form of service. Even then, when COVID-19 struck, Sanchez found it challenging to face the costs that came with his diagnosis.

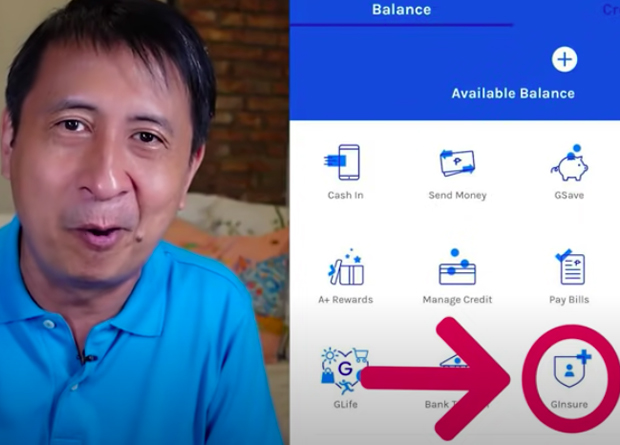

“Seeing my expenses were very real. It broke my heart when I realized how difficult it would be for others, especially those who got hospitalized,” he expressed. “I had an emergency fund, built after many years of investing and saving, but I knew that many didn’t. So I really believe GInsure is a gift. [It] has solved two of the biggest obstacles: affordability and accessibility, and I’m very happy that this is now available to many people.”

GInsure Cash for Dengue Cost with Free COVID-19 Coverage (CFDC) is an affordable and accessible insurance product by digital wallet service provider GCash, powered by mobile-first insurance provider Singlife. It can help cover COVID-19 and/or Dengue costs for up to almost half a million, and the pocket-friendly protection costs as low as less than PHP 1 a day. GInsure CFDC can also be easily availed using the GCash app, with the entire application process and all approvals done within.

Today, Sanchez continues to teach and inspire others virtually through his YouTube videos in hopes of helping improve the financial situation of Filipinos. He generously gives advice on handling finances better and protecting everyone’s financial future – a topic that is all the more relevant now in the middle of a health and financial crisis.

“I know a lot of people who have no choice but to go to work every day and so [GInsure] is a great back up plan. At least the financial challenge is already cared for,” he mentioned in his vlog. “A lot of people think that they will never have COVID-19 or that if they’re going to have [it, they will be] asymptomatic. I will recommend that you do not become overconfident – COVID-19 can hit anyone.”

With the unpredictability brought by the pandemic, GInsure CFDC brings peace of mind by securing the financial future of Filipinos and even provides the possibility of extending the insurance and protection to immediate family members. Especially for those who leave their homes for work and risk exposure to the outbreak, GInsure CFDC can be a back-up plan to care for unexpected COVID-19-related financial challenges. This affordable insurance option can be availed for as low as PHP 300 per year – with coverage of up to PHP 140,500. Varying coverage levels gives users the option to have coverage for up to PHP 421,500.

For more information on GInsure CFDC, head over to https://help.gcash.com/hc/en-us/articles/900006391263-Everything-you-need-to-know-about-Cash-for-Dengue-costs-