Cybercrime continues to be a rapidly rising threat, with cases in the Philippines tripling to 10,004 in 2024, according to the Cybercrime Investigation and Coordinating Center (CICC). CIBI Information Inc., the country’s first and only local credit bureau, recognizing the urgent need for a coordinated, data-driven approach to fight cybercrime, officially launches the Fraud Bureau.

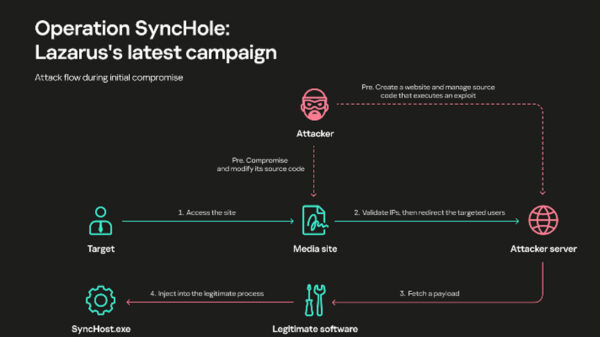

The Fraud Bureau is a collaborative initiative that unites banks, fintechs, and financial institutions to share data on potentially deceptive applicant activity securely. This data includes watchlist or blacklist information, as well as details from incoming applications and inquiries.

The Fraud Bureau is poised to become a vital platform for financial institutions to share intelligence and collaborate in fighting fraud. By compiling resources, the Fraud Bureau promotes proactive detection, speeds up identification, and strengthens cybercrime prevention efforts across the financial sector. This initiative aims to curb fraudulent activity within the country’s financial ecosystem by sharing data among key financial institutions, ultimately fostering greater trust and transparency across the industry.

“The significant increase in fraudulent activity highlights the urgent need for coordinated action. CIBI recognizes that data-driven collaboration is essential to tackling fraud—an insight that helped shape the Bureau’s framework and mission. This collaborative approach strengthens industry-wide defenses and supports greater trust and transparency in the financial ecosystem.” said CIBI President and CEO Pia Arellano.

Responsible fintech innovation

As the Philippines’ leading credit reporting agency, CIBI aims to advance financial inclusion by providing reliable data-driven insights to enable informed decisions for businesses and consumers in the Philippines. By partnering with like-minded organizations, CIBI enhances the effectiveness of shared information, driving stronger fraud prevention and greater transparency in the Philippine financial ecosystem.

Participating in initiatives like the Fraud Bureau allows financial sector players to enhance defenses against fraud and contribute to a safer, more transparent system. Through data sharing and collaboration, they can protect consumers and make a tangible impact in the fight against fraud.

“This initiative marks a meaningful step toward empowering Filipinos and fostering sustainable progress through responsible fintech innovation. By collectively combating fraud, we not only protect consumers but also build confidence in digital financial services—enabling broader adoption, financial inclusion, and long-term resilience in the country’s evolving fintech landscape.” said CIBI President and CEO Pia Arellano. CIBI invites fintech companies to join its Fraud Bureau and become part of a shared defense network. Through data sharing and real-time alerts, members help protect both their businesses and the broader financial ecosystem.