Pru Life UK seals a strategic partnership with the ATRAM Group (ATRAM) as part of the Company’s growth strategy to fulfill the evolving needs of its growing customer base.

The leading life insurer will soon onboard ATRAM as its local fund manager. Its expertise and solid track record in asset and wealth management will complement Pru Life UK’s superior selection of funds.

To achieve their shared goal of helping more Filipino families live wealthier, Pru Life UK and ATRAM will co-develop and launch more innovative and customer-centric investment solutions to further strengthen their investment performance for their customers.

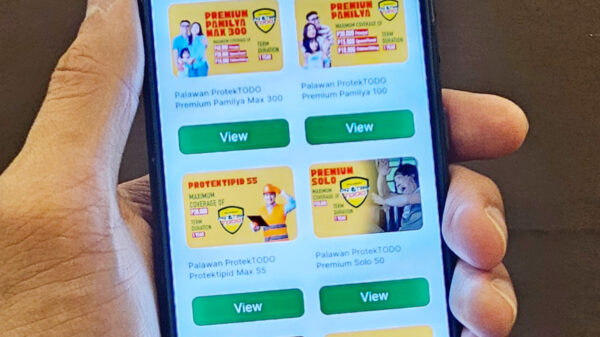

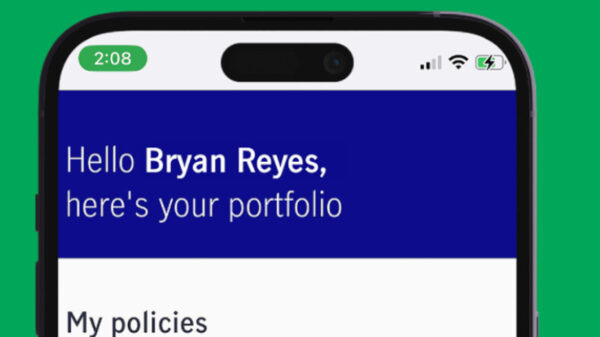

This will enable Pru Life UK agents to further value-add and enhance their customer network through a wider array of financial solutions. More importantly, Pru Life UK customers will gain access to ATRAM’s wide range of solutions and platforms to help them grow and expand their investment portfolio.

“We are delighted to have ATRAM as our co-advocate in helping more Filipinos achieve their financial goals. With this promising partnership, we are strengthening Pru Life UK’s growth trajectory and investment performance that will benefit our customers,” shares Eng Teng Wong, Pru Life UK President & CEO. “Our customers can count on Pru Life UK and ATRAM to help them grow their wealth.”

“We are excited to partner with Pru Life UK, the pioneer and leader in investment-linked insurance products. Our shared vision of securing the financial well-being of our clients is the foundation of our collaboration. We look forward to bringing the latest investment products and technology to Pru Life UK’s agents and customers helping them achieve their dreams and aspirations.” said Michael Ferrer, Chief Executive Officer of ATRAM Group.

ATRAM was selected following a rigorous evaluation and approval process. Certain transactions related to the partnership are subject to regulatory approval.