Every shopping experience begins with a motivational “Treat yourself!” to hype us up for a round of spending. But the excitement tends to be short-lived when our self-spoiling activity makes a dent in our bank accounts. From launching a 5% p.a. base savings interest rate that allows clients to Go Save faster without any limits or conditions, the Gokongwei Group’s GoTyme Bank offers next level banking by making guilty shopping a thing of the distant past with Go Shop—a permanent feature of the bank that allows you to earn Go Rewardspoints when you shop using your GoTyme Bank Visa Debit Card, a sleek and sexy card that allows you to shop—and earn points for it.

Recently, GoTyme Bank launched “Nice Card, Nice Rewards”, a campaign that highlights the endless possibilities you can have with your GoTyme Bank Visa debit card.

“We live in a highly globalized economy defined by advancements in technology, business, and banking. Consumers around the globe have turned to quick and easy methods of doing everyday transactions,” Co-CEO Albert Tinio stresses. “With Go Shop, you can earn, enjoy and share special rewards with your family and loved ones anytime you want. Here at GoTyme Bank, we bring together the convenience of debit cards and the benefits of reward points into one sleek and stylish card.”

Points Wherever. Unlike other cards that only offer niche rewards, GoTyme Bank made sure that you get rewarded for every swipe or tap of your GoTyme Bank Visa debit card. In a country where rewards are mostly offered by credit cards, GoTyme Bank’s debit card is one of the very few that offers rewards for every purchase. Both local and international transactions will allow you to earn Go Rewardspoints – making it one of the best debit cards in the country.

Points Boosted. From huge rewards to huge returns, GoTyme Bank wants to make sure your hard-earned money is well-spent. With 3x Go Rewards points with every purchase from partner merchants like Robinsons Supermarket, The Marketplace, True Value, and Toys R Us, each cent becomes worth spending, because you know you’ll be getting a lot back.

It was also announced that Caltex joined as a partner merchant – giving drivers a more rewarding drive when they gas up. Now, GoTyme Bank account holders can also enjoy up to 2x the points for every Php 300 when they gas up and pay using GoTyme Bank.

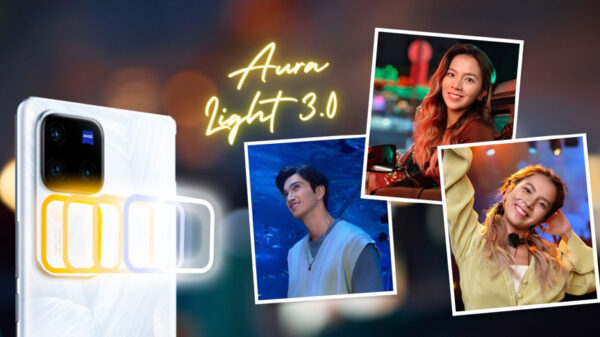

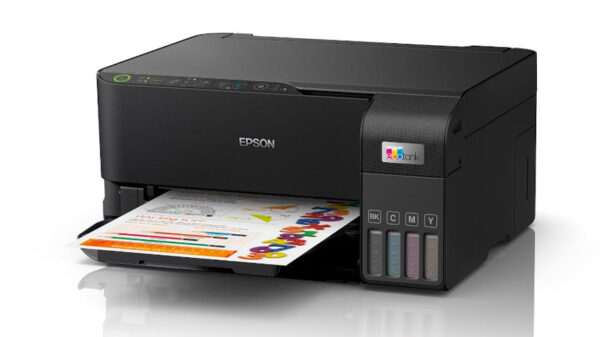

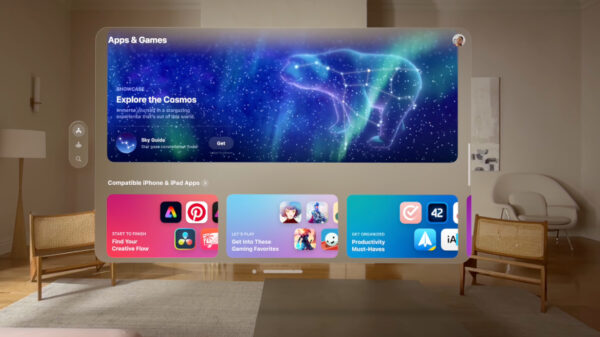

Points to Cash. On a final note, ever wonder how to enjoy your Go Rewards points? With GoTyme Bank, earning and claiming your rewards become equally exciting: redeem your Go Rewards points as cash, which will be debited directly to your GoTyme Bank Everyday Account, straight on the app or spend your Go Rewards points in any of the GoTyme Bank partner merchants! To maximize your purchasing power, you may choose to transfer the cash proceeds from your Go Rewards points redemption from your GoTyme Bank Everyday Account to your Go Save Account and earn 5% p.a. interest with it, which you can use in the future to pay bills or save for big purchases. Also, because the points that you earned will never expire, it becomes possible to reuse money you already spent and purchase the things you’ve only been dreaming about—like a cool gadget, nifty appliance, or a luxury piece you’ve always wanted to have. GoTyme Bank CEO Nate Clarke shares, “This card doesn’t just bring good looks, this card also delivers on substance. And in particular, it delivers on rewards and travel. Usually debit cards don’t have rewards. At GoTyme Bank, that’s not the case. Our partnership with Go Rewards makes our Visa debit card the most rewarding in the market.”