By Edler Panlilio

Managing Director, SAP Philippines

If revenue is the lifeline of an organization, then finance sits at its heart – monitoring the corporate pulse, keeping an eye on plans, budgets, and costs; reporting results, in a race to keep it thriving and stay ahead of the unknown.

While finance’s role has gradually evolved, the past year has seen a radical transformation as businesses went digital, redefined their operating models and offerings, and reinvented themselves in a fast-evolving landscape.

In the Philippines, for instance, businesses, particularly medium-sized enterprises, continuously embrace digital to cope with the new normal. Even before the pandemic, some Filipino businesses have begun offering products and services online as they complement their existing brick and mortar stores with e-commerce to broaden their consumer base and expand their market. Many of these enterprises also set up social media pages to post images and details about their offerings.

A 2018 survey on SMEs in the Asia Pacific,[1] including 500 SMEs in the Philippines, revealed that 96 percent of surveyed enterprises use e-commerce, which helps generate 52 percent of their revenues. It also showed that 95 percent of the SMEs use social media tools, and 81 percent use emerging technology to improve supply chain and distribution.

When the pandemic started last year, supply chain trades have been disrupted, forcing businesses and consumers, even more, to go digital. At the height of the quarantine guidelines and lockdowns, the Department of Trade and Industry (DTI) recorded about 88,000 new online businesses by the end of 2020. Most enterprises also implemented work-from-home setups, and consumers drove the rise of e-commerce, digital payments, and online transactions.

Due to limited mobility, it indicated a substantial fall in retail activity, with analytics on freely available big data showing an 80 percent drop in visits to malls, restaurants, and movie theaters, according to a recent report by the World Bank and the National Economic and Development Authority (NEDA).

It’s a crucial period for finance itself to evolve and stand ready to lead the charge in driving innovation and strategic business planning. What does it take to do so?

Financial resiliency: a watertight ship

The pandemic has presented businesses with unprecedented challenges and opportunities, making change a necessity for survival and posing new demands on the finance function. This is especially so for small and medium enterprises where the CFO may wear multiple hats.

As organizations recalibrate their sights for future growth, what comes to the top of mind of business leaders now are ensuring financial resiliency – having certainty that the bold steps taken will pay off and be profitable, allowing the business to break into new markets and acquiring new audiences.

Besides ‘keeping the lights on,’ CFOs are now called upon to be business strategists, providing visibility into the organization’s assets and real-time financial standing, allowing the C-suite to make the critical decisions that would set the pace for an organization’s long-term business direction.

Finance conversations are gradually shifting towards the perspective of value, rather than just cost, and enabling innovative change across the organization and highlighting what needs to be changed to enhance the value proposition. It’s a tall standing order considering the significant changes across the organization – from customer revenues, expenditure and pay rolls, and taking a wide view of performance across diverse stakeholder groups.

Yet, CFOs don’t do this alone – under their belt, technology is enabling finance to super-charge the executive decision-making process.

Finance drives innovative growth

In the past, finance functions were primarily concerned with reporting on figures over the previous month, in contrast to current expectations of it being innovative and providing the much-needed visibility over the organization’s financial health as it navigates an uncharted era.

To achieve this, companies require a radical shift towards intelligent finance – as the heart of the business, ensuring a strong digital backbone that enables businesses to increase efficiency, visibility, and streamline processes.

Transforming the finance function not only enables an always-on, real-time capability, but allows the organization to ‘micro-adjust’ the way they operate and ensure business continuity – a reflection of the reality of the modern business and increasing succession and frequency of unexpected disruptive events.

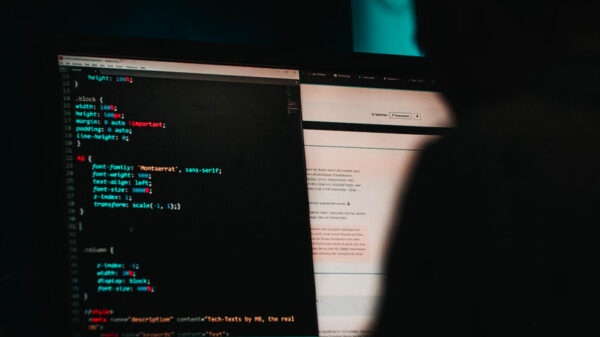

Accelerated by the shift towards remote working, tapping on the cloud-integrated intelligent solutions has allowed workflows and processes to be automated, simplified, streamlined and, in some cases, removed redundant processes from much of the day to day, manually intensive, transactional work. Key to this is upskilling finance employees to leverage digital technologies that can help them do their job more effectively and efficiently.

Freed from number crunching, employees can immediately obtain critical information with the highest accuracy, tapping on artificial intelligence and machine learning driven insights to create predictive forecasts.

These benefits ladder up towards organizational success – finance leaders now have the critical data to present and help the leadership shape and executive strategy, with detailed, real-time insights to inform and enable the organization for success.

Embracing digital transformation

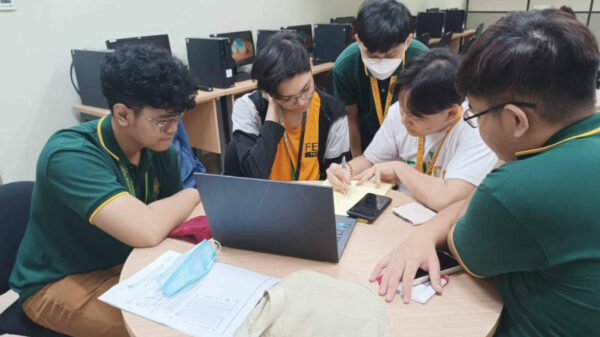

Some midsized organizations have already embraced digital, such as the cloud, to jumpstart their transformation journey. The Lyceum of the Philippines University (LPU) is among these organizations, which recently integrated SAP Business ByDesign (SAP-ByD) into their systems.

SAP-ByD, a single cloud ERP software for fast-growing, midsize organizations, is a complete end-to-end business digital suite that helps midsize organizations grow and unite all areas of the organization’s functional departments and processes. This solution offers end-to-end financial and distribution management systems, integrating sales, ordering, invoicing, logistics, and payment collections.

As a leading educational institution, Lyceum of the Philippines utilized SAP ByD to improve and streamline its accounting processes, particularly its Cavite and Intramuros, Manila Campuses. LPU managed to gain data visibility and improve its reporting systems.

“LPU Cavite used to process everything manually. By going digital, it made our recording of transactions easier. And since it is now easier to monitor all transactions, it also eliminates logbooks and makes our reports readily available,” said Sandra Biance Sto. Domingo, Chief Accountant of LPU Cavite.

Meanwhile, in LPU Intramuros Campus, Chief Accountant Rizalina Benico said that based on their experience with SAP since February this year, they are confident that they will generate all the financial reports with ease and accuracy.

Last year, the government sector in the Philippines have seen the importance of cloud-adoption. The Department of Information and Communications Technology (DICT) even amended its Cloud First Policy to provide more precise instructions on policy coverage, data classification, and data security, marking a step towards cloud realization in the Philippines.

Businesses, on the other hand, are optimistic about using cloud technology. According to a report commissioned by Alibaba Cloud, 94 percent of surveyed firms in the Philippines view cloud-based IT solutions as an essential factor in mitigating the impact of the pandemic.

The same report also revealed that 88 percent of these businesses stated that they are now more supportive of using cloud-based IT solutions to grow their businesses than before COVID-19, among the highest of the markets surveyed.

Rising to the challenge

While organizations are already well on their way in digital transformation and adapting their offerings amidst the evolving landscape, it is crucial especially for small and medium sized businesses to scrutinize and revamp their finance function, even as they tighten purse strings and spend prudently.

Having a strong financial standing not only gives business leaders confidence of their current strategy, but also the ability to make the transformational actions needed in the current climate. Even as unpredictable events continue to emerge in quicker succession, it presents challenges to finance functions at all levels, necessitating a shift in priorities and emphasis on managing the bottom line and then being able to predict and empower the organization through insights.

By turning finance, the heart of the organization, into an intelligent core, this embodies its already unique position to support the business with critical information for agile business decision-making. With better visibility across the business and agility, organizations can then make bolder, more nimble steps in the right direction and prudently invest towards future innovation and the next era of growth.