The financial services industry today is going through exciting times, thanks to technologies that are making financial products and services accessible to more people.

At the first Finovation 2018 event, J.P. Ellis, Group CEO and Co-Founder of eCompareMo.com’s parent company, C88 Financial Technologies, said that artificial intelligence, big data, product customization, blockchain, and information security are shaping the Philippine financial technology landscape.

“Artificial intelligence tools, such as chatbots, are the future of financial technology. The more you talk to them, the more sophisticated they become,” said Ellis in his keynote speech. Ellis adds that AI can lower costs and allow providers to offer personalized customer experiences.

“Big data will improve virtually everything, from pricing risk to detecting fraud,” continued Ellis. And with data, financial services providers can create specific products for certain demographics and offer customized interest rates, terms, and conditions.

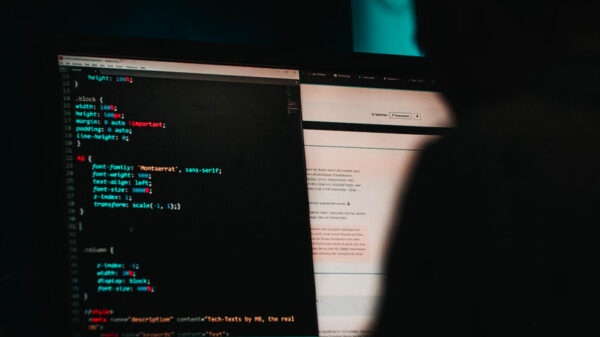

As for information security, the industry can take advantage of world-class information security and cybersecurity standards by leveraging cloud computing.

“We at eCompareMo are committed to information security and sanctity of customer information so we implement security measures like internal audit, penetration testing, SSL certificates, and so much more,” said Ellis.

Meanwhile, blockchain technology can beef up security through public ledgers, reduce remittance fees for OFWs, and reduce time lags for financial transactions, according to Ellis.

“With the expertise and deep understanding of the developments we have today, eCompareMo is in an advantageous position to help financial institutions adapt to these new technologies and maximize their positive impact to their businesses and the financial experience of consumers,” said Ellis.

One-stop shop

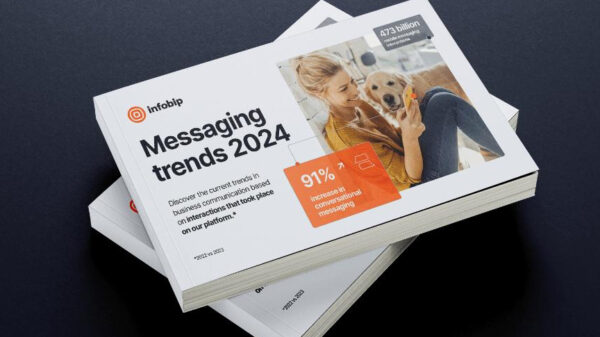

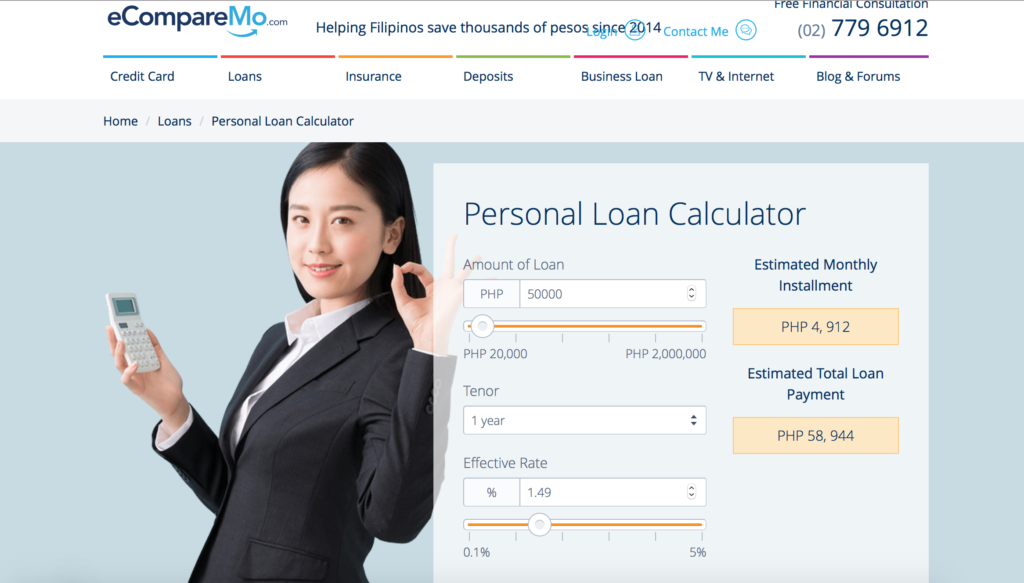

A financial supermarket for banking and insurance services, eCompareMo was launched in 2014 with only five employees. “We now have two sites with 200 employees serving credit cards, loans, and insurance needs of Filipinos,” said Stephanie Chung, managing director and co-founder of eCompareMo.com.

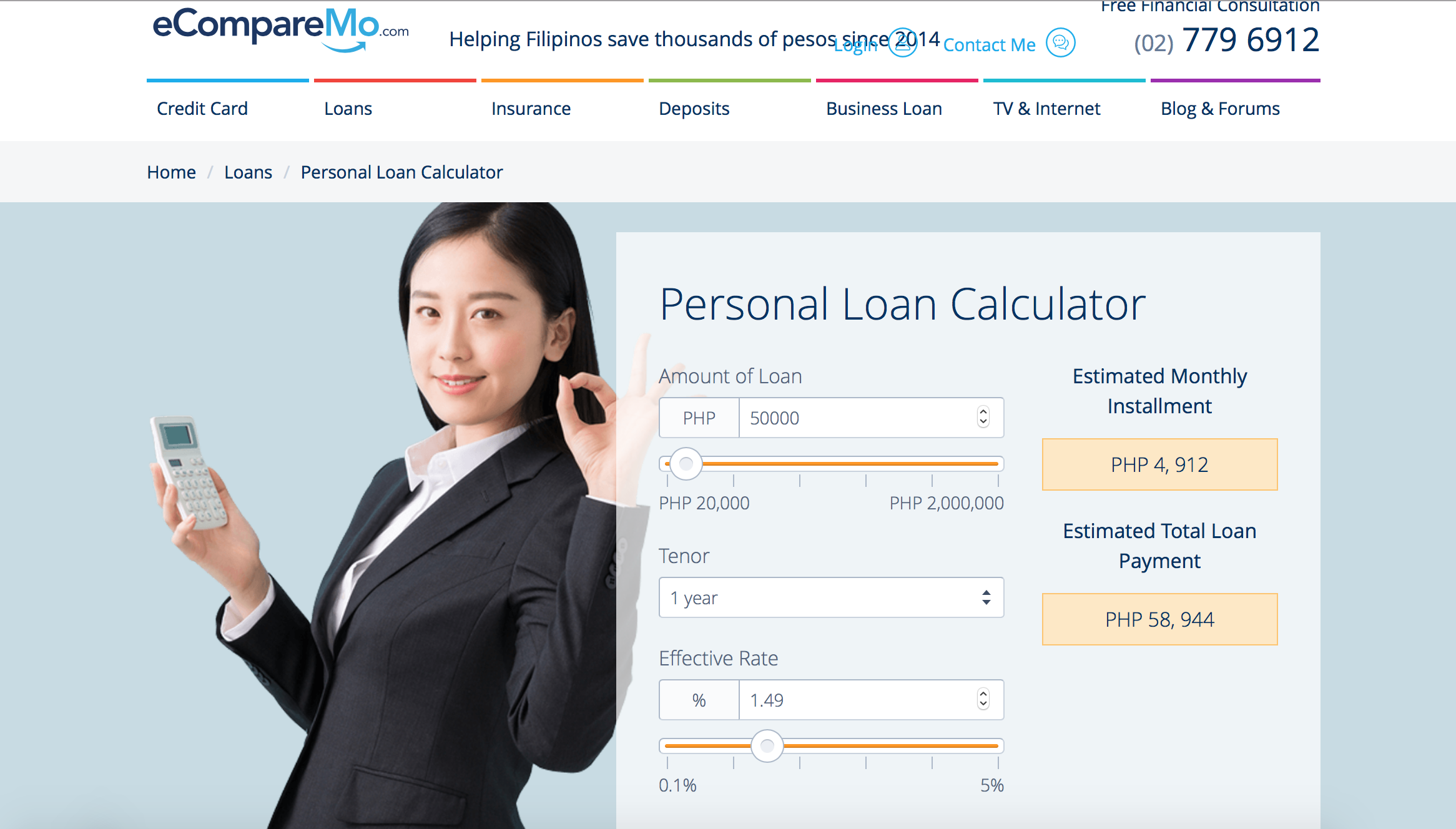

The portal serves as a one-stop shop for users applying for a credit card, loan, car insurance, and other financial and insurance products without having to go from one website to another or call insurance providers one by one.

Users can compare interest rates, credit card features and perks, and insurance quotations—and apply on the spot for their product of choice. As a value-added service, eCompareMo.com delivers the country’s first and only Car Insurance Concierge—a helpdesk for insurance policy issuance and renewal, as well as claims processing assistance across different providers.

Chatbot Alex

In a bid to enhance the financial experience of consumers through groundbreaking technologies, eCompareMo.com launched during Finovation 2018 the portal’s AI bot dubbed “Alex”.

In a presentation, Ched Limson, eCompareMo.com’s Chief Commercial Officer, demonstrated how chatbot Alex can recognize photos of valid IDs and documents and distinguish them from invalid photos.

Chatbot Alex can also alert people of the status of their application and suggest related financial products to customers, according to Limson. Alex is also capable of handling multiple commands, and can provide unsolicited assistance.

“We’re not just looking to disrupt the market. We’re here to augment the human element with technologies like artificial intelligence and chatbots,” said Ellis.