IPC PayCheck, a timekeeping and payroll solution with add-on HR features offered by local cloud solutions pioneer IPC (IP Converge Data Services, Inc.), has adjusted its system to reflect the new tax computations under the recently-approved Tax Reform for Acceleration and Inclusion (TRAIN) law. The latter is the government’s program that seeks to provide a fairer and simpler tax system for Filipinos.

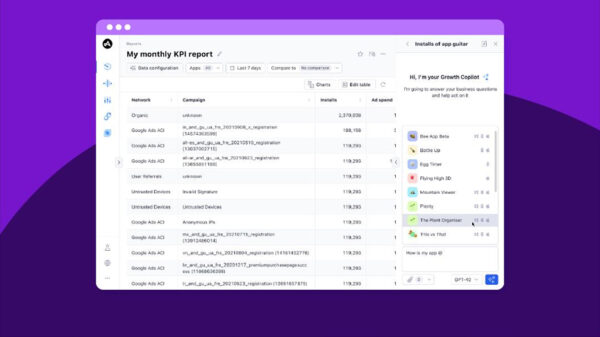

IPC PayCheck is an HR tool that streamlines and automates the management of employees through a digital means of timekeeping, leave filing, and compensation and benefits computations. The system also helps eliminate errors and speed up the completion of tasks, freeing more time for other vital activities like employee engagement and training, as well as other core business processes. IPC PayCheck looks to improve its features according to market feedback and needs of the times.

“IPC PayCheck is a productivity suite of scalable payroll and timekeeping solutions that help HR employees perform their work, easily and accurately,” said IPC COO Dave R. de Leon. “It’s apt for any organization — from startups, to small-and-medium-sized businesses, and even large enterprises who are looking for a digital approach to carry out manual, repetitive tasks in no time, and one that will allow them to focus on vital tasks that will help the company grow further.”

IPC PayCheck’s clientele is expanding as more and more companies shift from on-premise to cloud-based HRIS (Human Resource Information System). This is due to businesses’ increasing interest in innovation and cost-reduction efforts.

Aside from personal income, the TRAIN law or Republic Act 10963 decreases the tax on estate, and donations, while increasing the excise tax on certain products such as petroleum, automobiles, sweetened beverages, and cigarettes; as well as non-essential services like invasive cosmetic procedures. The law took effect early this year.