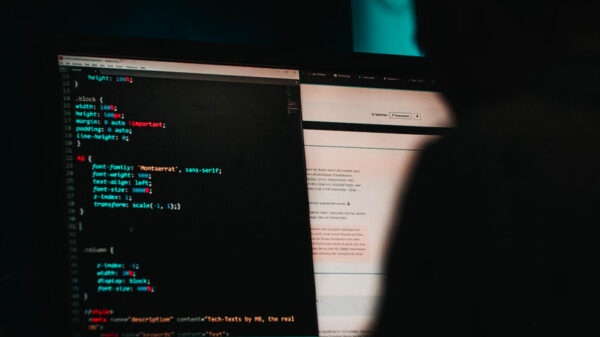

A recent survey by global analytics software firm FICO has revealed that while 73 percent of Philippine banks believe AI will strengthen anti-money laundering efforts, many remain unsure how to operationalize the advanced technology.

Conversely, when asked about the efficacy of much older rules-based technology, 95 percent of Philippine banks say they still believe in the ability of these AML systems, despite 36 percent saying they experience significant struggles modifying them.

“Rules-based compliance systems continue to be the workhorse for banks in Asia Pacific when fighting financial crime,” said Timothy Choon, FICO’s Financial Crimes Leader in Asia Pacific. “However, some early adopters are starting to embrace the new world of AI and realize that the decade-old rules-based systems can’t keep up with sophisticated threats on their own.

“The secret sauce is operationalizing advanced AI technology and making it work side-by-side with the rules-based systems. In fact, 20 percent of respondents picked this as their principal obstacle in meeting financial crime risk mitigation targets.”

The survey showed that the key challenges for existing AML compliance solutions regionally were: the ability to meet new types of compliance risks in channels and products; the capacity to provide an end-to-end integrated compliance solution; and the facility to update quickly to changes in regulation.

Across Asia Pacific, larger multinational banks were more likely to use a vendor solution for AML, while the use of an in-house system was more common with domestic banks.

Key drivers of financial crime strategy

One of the leading indicators driving change in financial crime strategy is customer experience. Over two-in-five respondents ranked this in their top considerations with 17 percent of Asia Pacific banks citing it as the primary factor behind their current and future approach.

“We can see that addressing the competing needs of regulatory compliance and customer experience remains a balancing act for most institutions,” said Choon. “Banks are challenged by the need for more information to deal with high rates of alerts from ineffective systems, while not vexing customers with incessant due diligence questions.”

Additional considerations ranked second and third by banks included, reputation damage and direct financial losses. When it came to financial crime challenges almost half of respondents cited the speed of responding to new threats, while a third believe achieving accurate detection remains a significant test.

FICO’s comprehensive compliance solution incorporates advanced machine learning techniques designed to address these challenges by significantly improving detection accuracy through patented advanced analytics models such as Soft Clustering Misalignment and Threat Score which can help financial institutions operationalize AI within their existing compliance strategies.

Investment in compliance technology

A significant majority of banks (93%) across Asia Pacific are likely to continue their technology spend on either upgrading or enhancing their compliance systems. However, in the key regional financial centres of Singapore and Hong Kong only two-thirds of respondents indicated that their banks are likely to start new investments in compliance technology, likely due to their more significant spend in this area in recent years.

In the Philippines, 100 percent of banks said they will continue to invest in compliance in the year ahead and 41 percent plan to significantly increase this investment in 2021.

Overall levels of investment in compliance technology by banks in Asia Pacific are expected to rise in 2021. 49 percent of respondents said budgets will increase, with an additional 34 percent expecting a significant increase. Interestingly, foreign banks are more inclined towards new spend compared with domestic counterparts. Indonesia, Australia, Thailand and the Philippines were the markets that said they would invest the most in 2021.

“This survey, conducted in May, shows that even in the recent economic downturn triggered by the pandemic, banks remain committed to targeted spending that boosts their AML compliance defenses,” said Choon. “There is an increased willingness to perceive compliance and fraud as a common financial crime risk – a fraudster is more likely to launder money, and vice versa.

“This convergence is a global trend. Banks in the US and UK are well on their way to fully integrating their compliance and fraud functions, bringing together teams, leaders and technologies. We believe banks in Asia Pacific are looking to these markets to see what will work, with plans to follow quickly in the next 24-36 months.”

FICO’s Integrated AML Compliance Survey was produced in May 2020 using an online, quantitative poll of 256 senior executives from banks across eleven countries carried out on behalf of FICO by an independent research company. The countries and regions surveyed were Australia, Hong Kong, Indonesia, Malaysia, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.