When women are empowered, everyone—their families and the community—wins. And one tool that can help women fight poverty and hunger is financial technology.

“We believe that technology is really the enabler to catalyze poverty alleviation,” said Gigi Gatti, Regional Director for Asia at Grameen Foundation, a global nonprofit that creates solutions spanning financial, agricultural, and health services. The foundation’s mission is to enable the poor, especially women, to create a world without poverty and hunger.

JG Puzon, President and CEO of POSIBLE.Net (left) and Gigi Gatti, Regional Director for Asia at Grameen Foundation

“In the Philippines, we started by working with microfinance institutions. We want everyone to be able to access financial services such as payments, savings, credit, and insurance—the four components of financial inclusion.”

However, Gatti noted that access to financial services has been hampered by poor infrastructure, particularly telecommunications. “Because of these problems, 37% of municipalities in the Philippines were unbanked in 2014, leading to a rise in alternative providers such as pawnshops and remittance centers. And because of the additional 50,000 alternative providers, the percentage of unbanked municipalities is now down to 11% as of 2016.”

However, today, there are still 563 LGUs that remain unserved by banks because of poor telecommunication signals, thus self-assisted banking channels such as mobile banking are not possible in these areas. “This means that self-assisted banking channels which we at Grameen Foundation were banking on to serve the unbanked is not going to happen in the next few years,” said Gatti.

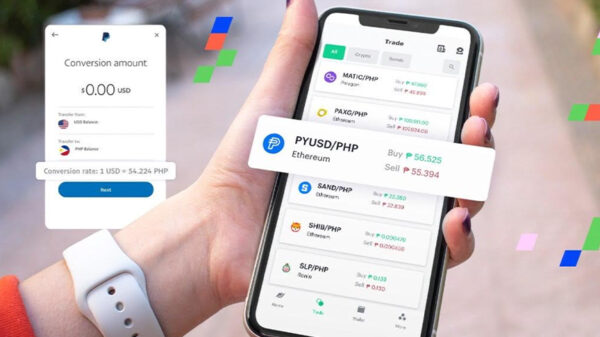

It is in these unserved markets that agent-assisted digital platforms will remain relevant, according to Gatti. An agent-assisted digital platform the Grameen Foundation supports is POSIBLE.Net, a fintech and digital services provider that offers bills payment, money services, and mobile loading among others, via a wireless point-of-sale device.

The POS device, which can be deployed in sari-sari stores, laundromats, bakeries, barbers shops, and other community-based businesses, offers services such as utility bills payment, select government fees, money services, micro-insurance, mobile loading, online gaming credits, and ticketing. Each transaction also comes with a confirmation receipt, gaining the trust of consumers.

The POSIBLE.Net device also has a camera to capture IDs that require identification for some transactions.

Bringing digital transactions closer to all communities

Founded two years ago, POSIBLE.Net currently has over 1,900 Ka-Posible retailers and has generated close to P2 billion worth of transactions.

JG Puzon, President and CEO of POSIBLE.Net, said that the from conception to design to execution, POSIBLE.Net had the MSMEs in mind.

“These small enterprises make up for most of the businesses in the country, yet they are fragmented and thus have no bargaining power. By putting them all in a single agnostic platform, with no corporate agenda in mind because we do not have our own product, it is our aim to unify them and empower them individually and as a group.”

Puzon believes POSIBLE.Net plays a key role in attaining financial inclusion in the Philippines by bringing digital transactions closer to all communities.

“You can now deposit in your bank account through a Ka-Posible agent,” noted Gatti. “And make cardless ATM withdrawals.”

Apart from helping Filipinos save and send money, the POSIBLE.Net POS device can help many entrepreneurs, especially women, provide secure lives and bright futures for their families. By investing about Php35,000 in a POSIBLE.Net device, women can offer financial services from their homes or businesses they currently operate, such as sari-sari stores and beauty salons. Ka-Posible agents make money for every transaction.

According to Gatti, there is a $60-billion gap in payments services and a $57-billion gap in savings and credit services in the Philippines, a huge revenue opportunity for Ka-Posible agents.

“Today, 75% of Ka-Posible agents are women, that tells a lot in terms of the economic impact of a business model such as Posible.”