MACAU—Channel partners—specifically the distributors and resellers of IT vendors—need to keep riding the wave in the technology industry to survive the tremendous disruption caused by new technologies and business models.

Steve Brazier, President and CEO of Canalys: “The market has changed. It is no longer growing.” PHOTO: MELBA BERNAD

“The channel hasn’t changed at all; what has changed is the technology industry, and you need to keep riding that wave,” says Steve Brazier, President and CEO of Canalys in his opening keynote at the recent Canalys APAC Channels Forum which attracted 530 channel partners from over 30 countries in the region.

Brazier noted that the four core elements—PC, server, storage, and smartphone—that have underpinned Asia Pacific’s channel industry for the last decade have not been performing well. For instance, distributor revenues from PC sales have gone down 15%, as well as revenues from the sale of smartphones (-6%), servers (-3%), and storage (-2%). “The market has changed. It is no longer growing,” says Brazier.

But China has a brighter outlook. Distributor revenues there have increased in the areas of storage (11%), servers (16%), and smartphones (6%). Only the PC market has declined by 10%.

“The Chinese market is divorcing itself from the rest of the world,” said Brazier. “We see a market where China is completely separate from the rest of Asia.”

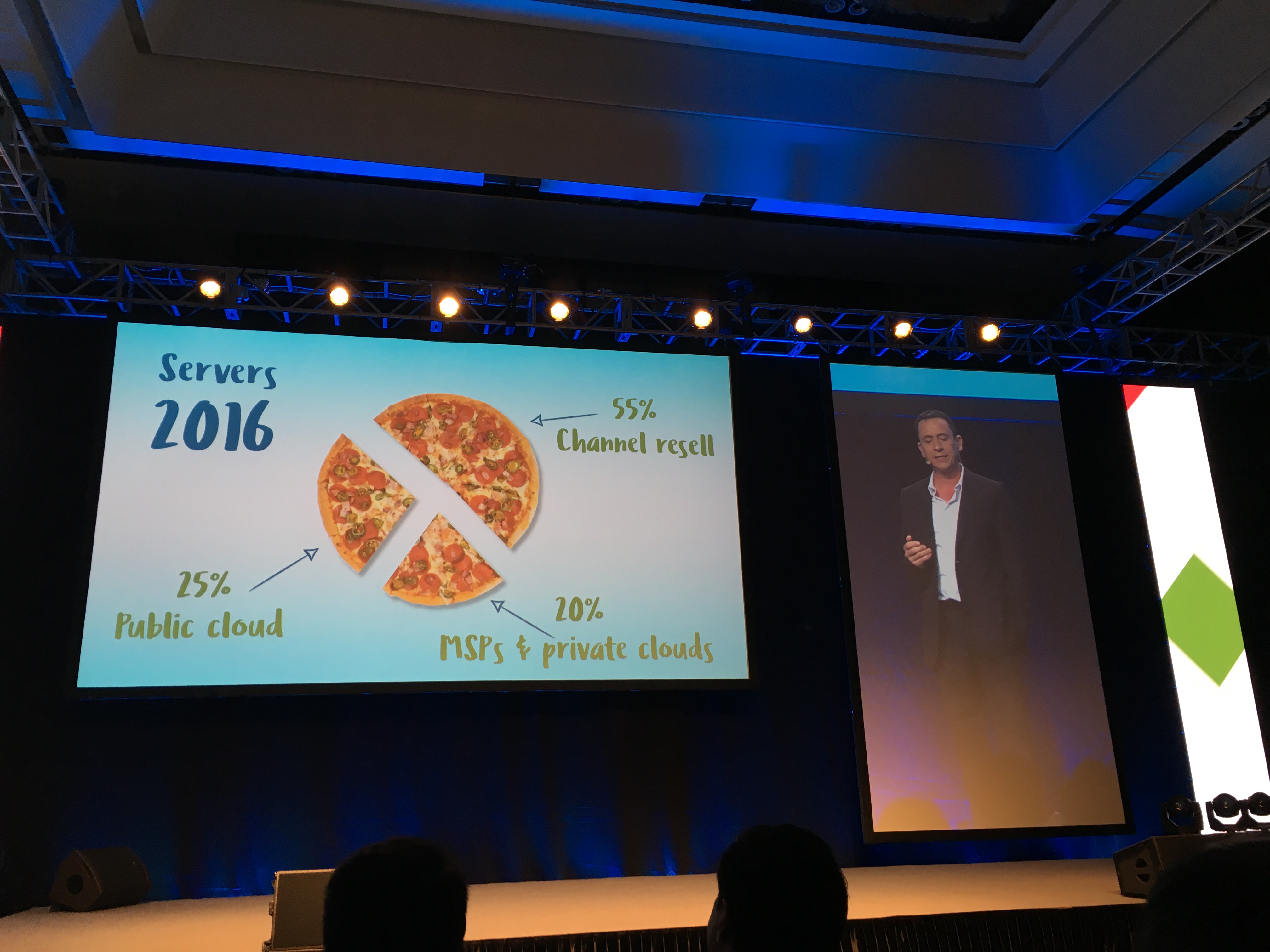

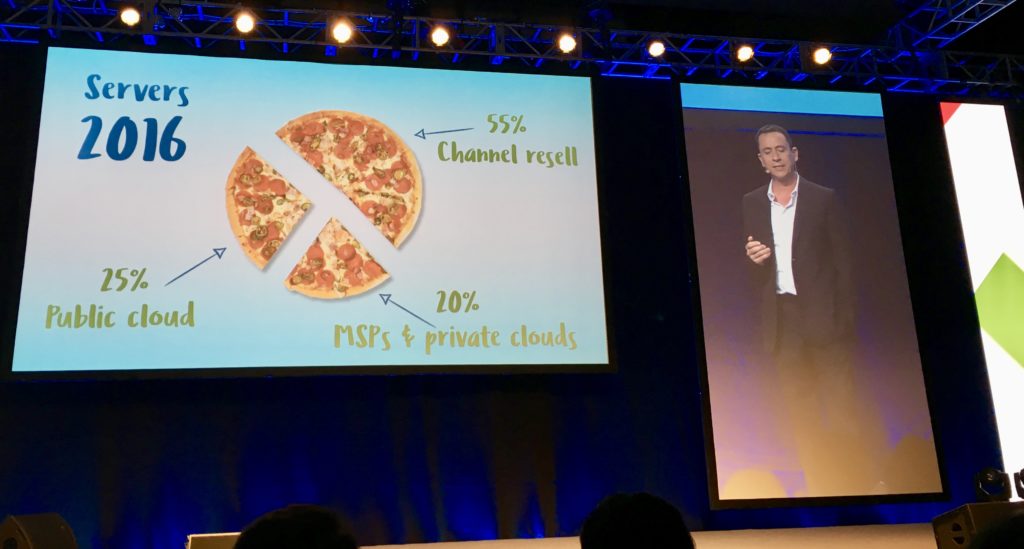

The move to cloud computing and a change in the server market have also affected the channel business. Brazier explained that in 2013, 75% of the server market went through channel resellers. This year, because of the public cloud and the rise in the number of managed service providers, only 55% of the server market was commanded by the channel resellers.

Brazier also said that the merger of Dell and EMC, and the split of HP into two companies, have made an impact on the channel business.

Areas of growth

With the changes happening in the technology industry, “the vendor community is really feeling the pressure,” says Brazier. However, despite the challenges, there are growth areas which channel partners can pursue, according to the Canalys chief.

Across the Asia Pacific region, governments are taking deliberate actions to encourage digital transformation, presenting a huge opportunity for channel businesses, says Brazier.

In terms of technologies, a growth spot for distributors in APAC is WiFi, which is expected to grow by 4% this year in APAC (minus China), and 47% in China. Other growth areas include detachable tablets (which is expected to grow over 400%), flash technology (over 100%), and hyper-converged infrastructure (90%).

“Asia has been late to discover the importance of security. But the Bangladesh heist has led to a strong growth in security,” says Brazier.

Per industry, growth opportunities in the software area include augmented reality, machine learning, and blockchain technology, says Brazier. In the hardware industry, growth will come from 3D printing, energy, robotics, autonomous vehicles, and 5G.

“The biggest trend in the web this year is the rise of messaging apps. Messaging is becoming a key way for people to interact with the internet,” says Brazier. “Messaging apps launched by Asian vendors have dominated the market, growing faster than rivals in other regions.”

In the area of cloud computing, a key development this year has been the cloud marketplace. “The aggregation of cloud services is a compelling benefit,” says Brazier, noting that the top three public cloud service providers—Amazon Web Services, Microsoft Azure, and Google—dominate over half of the public cloud market which is expected to grow at over 50% this year.

“We see a problem among these three big public cloud providers. They are too big to fail. If one of them goes down, they are going to bring businesses down with them,” says Brazier, adding that channel partners can see this as an opportunity to provide hybrid IT services since many companies will not fully embrace cloud computing.

Managed service provisioning and colocation services are also fast growth areas for the channels, according to Brazier. “The exit from the managed services business by Dell, HP is good for the channel,” says Brazier. Today, 10% of technology distributors in APAC describe themselves as MSPs. “By becoming managed services providers, you become more independent from vendors,” says Brazier.