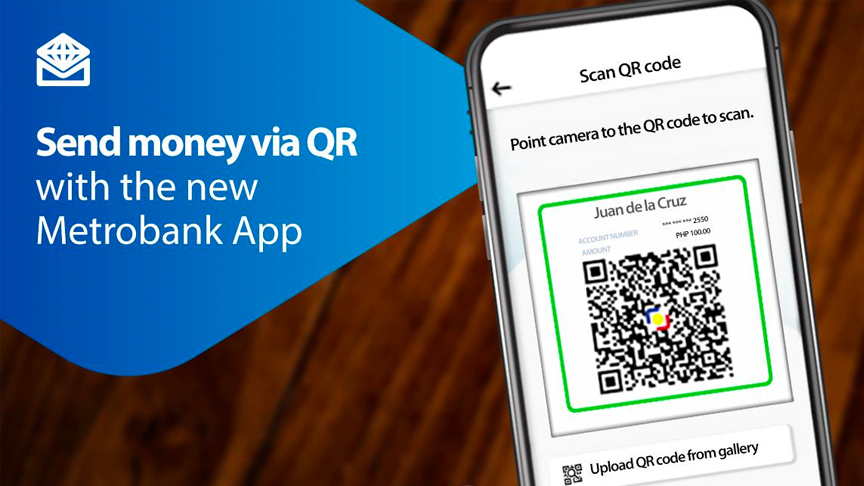

Sending money to friends and family is now much easier for Metrobank account holders as QR becomes available on the NEW Metrobank App.

With this new feature, users only need to scan or upload a QR code to instantly transfer funds to peers and other bank or e-wallet accounts, to make banking safe, simple, and secure.

As an added treat, Metrobank users who will send money worth PHP1,000 and below will enjoy waived InstaPay fees until September 30, 2023.

Accessing this new feature is easy! Just follow these simple steps:

- On your Metrobank App’s dashboard, tap “QR” at the bottom navigation menu.

- Scan or Upload the QR code of your recipient.

- After scanning the QR code, fill in the required details for your fund transfer. PHP 0.00 transfer fee should reflect in the confirmation page for transactions worth PHP 1,000 and below.

Users can also start receiving funds in an instant via QR on the new Metrobank App. Here’s how:

- On the dashboard’s bottom navigation menu, tap “QR”.

- Select Generate QR code and provide the needed details. Here, you can already indicate the amount you wish to receive to make it more convenient to the sender.

- After generating your unique QR code, you can easily share it to the person sending you money or save it on your device so you can send it later on.

With this new feature on the NEW Metrobank app, transferring funds to and from your account is a breeze! Metrobank’s fund transfer via QR is enabled by QR Ph, the national standard for QR payments launched by the Bangko Sentral ng Pilipinas.

To enjoy a smart, simple, and secure banking experience anytime, anywhere – make sure to download the new Metrobank app from the Apple App Store, Google Play, and the Huawei AppGallery, and update it to the latest version (ver 1.7.1).