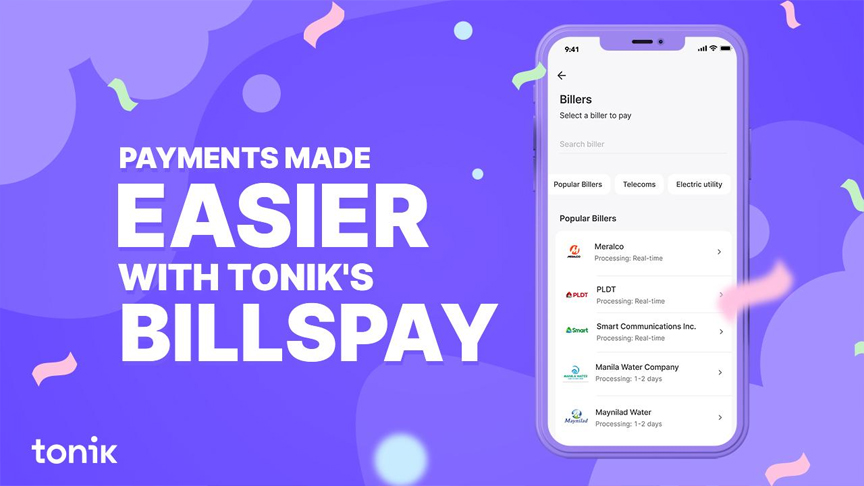

Tonik, the country’s first neobank, continues to be every Filipino’s partner to easy, stress-free, and accessible banking through its BillsPay feature. Available through the Tonik app, BillsPay enables users to seamlessly pay their bills on time, without the hassle of long queues and even at the comfort of their own homes – all through a few taps on their mobile phone.

“With Tonik at the forefront of fintech in the Philippines, we are constantly expanding our product offerings to cater to all the financial challenges Filipinos face on a daily basis as we accelerate financial inclusion,” explains Founder & CEO Greg Krasnov. “Going through the pressures of monthly dues often creates tremendous stress for our users, but we make it our goal to help them remain on top of their finances. Now, through BillsPay, we offer an easier way to settle your bills at your own convenience.”

Made possible in partnership with Bayad, a pioneer and leader in the outsourced payments industry, users can settle their dues with a wide range of billers right in the Tonik app. This includes top utilities such as MERALCO, PLDT, Maynilad Water Services Inc., Manila Water Company Inc., Smart, Converge ICT, Pag-IBIG, Easytrip Services Corporation, Metrobank Credit Card, and Visayan Electric Company (VECO). Soon, more merchants and billers will likewise be made available in the app. Payments are posted within 48 hours of transaction.

Users who share a Group Stash can save together to pay a bill. Once the target amount is reached, the Group Stash owner can move it to their Tonik Savings Account so that they may pay the bill.

“With BillsPay, Filipinos can manage all their expenses and face each month worry-free,” adds Krasnov. “Users can even pay for their family’s or friends’ bills if they need an extra hand. It is fast, easy and accessible—exactly the kind of banking partner Filipinos deserve.”

Learn more about this story at https://tonikbank.com.