The banking industry has certainly had to contend with many changes in recent years, some of which have remade the industry’s very foundation. From new forms of security that previous bank leaders could have never envisioned, to loan applications and decisions on bankable clients based on incredibly granular client data, the banks of today have to face new challenges that seem to crop up daily.

Customer attraction is one of the challenges that banks have always had to deal with, but most banks have never had to engage a market demographic quite like today’s digital natives. The millennial and Gen-Z generations, and the technology that they grew up immersed in, present banks with new hurdles to overcome in their pursuit of loyal, bankable clientele. If you find that your bank is lagging behind in finding a digital banking platform as a way of catering to this highly valued market segment, here are some tips you should consider.

Multichannel Touchpoints for Increased Client Engagement

One of the indelible ways that technology has impacted today’s generation is through communication. In the past, communication was relatively limited. If you had to make a phone call, you had to hope that the person you were trying to reach was at home when you decided to reach out. Letters and physical mail took days or sometimes weeks to arrive. These restrictions weren’t just inconvenient for individual users looking to connect with their friends and loved ones. They also limited the scale and success rates of crucial business operations such as customer service and client relationship management.

Today’s generation has never had to worry about any of that. Smartphones are more ubiquitous than ever, making communication and engagement possible at any time of day or night, in almost every corner of the world. More importantly, millennials and Gen-Zers have come to expect this immediate communications convenience. To win their accounts, banks will have to keep up with these expectations. They will need a software foundation that will allow clients to engage with bank staff across whichever communications channel they prefer. SMS, messaging apps, and automated chatbots are all part of the digital native’s world, so for banks to remain relevant, all these will have to become part of bank operations.

Client-Originated Product Development

If there’s one word that almost perfectly describes the lifestyle that digital natives have become accustomed to, that word might be “immediate.” Millennials and Gen-Zers are not often very far away from their smartphones. By using these devices, they have access to whatever they want or need. What’s more, they’re likely to receive their purchases within an hour or less, all without ever needing to leave the comfort of their homes.

Banks will need to adjust to this major change in the way that people shop today. In the past, banks would roll out investment or loan products that they felt best served their own bottom lines. If clients didn’t like what was offered, they would have to do some legwork to find a bank that had what they were looking for.

By contrast, today’s bank clients can dramatically cut down on the time and effort needed to shop around. Instead, they just have to hop onto the Internet to compare lending options and interest rates between competitors. Also, the entrance of financial technology companies into the financial services market has increased competition considerably, giving clients more flexibility for choice than ever before.

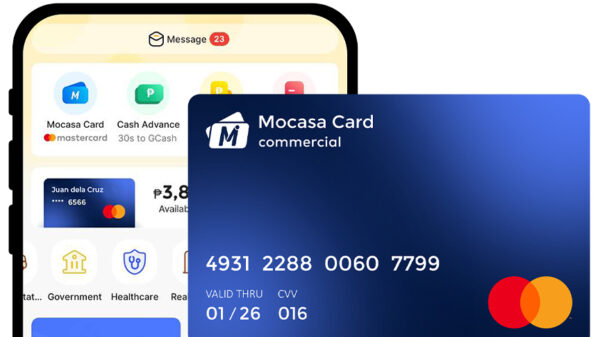

Banks that allow their clients to define the rules of engagement will be able to stay one step ahead and, more importantly, win clients that will stay with them for the long haul. To do this, they’ll need to allow clients to design their own savings and investment products. These products should not only fit each client’s needs and lifestyle, but also serve bank objectives. For example, clients might want a savings account with an above-market interest rate. A bank that can offer this, in exchange for a higher maintaining balance, would win a loyal customer for itself and establish a reputation as an institution that has its clients’ best interests at heart.

Omnichannel Service

Smartphones aren’t the only way that digital natives stay connected to and engage with their world. Therefore, forward-looking banks must recognize this and offer service platforms across multiple technologies. Having an in-house mobile app and web portal are considered standard parts of a bank’s service infrastructure at this point. That said, banks with an eye to the future must dive deeper into these existing assets to see how else they can be deployed. Additional functionalities are the next frontier for banking technology. For example, banks can look into integrating their allowing account actions to be inputted by voice command and integrated into wearable devices such as smartwatches.

Finding the right solution to connect with the millennial and Gen-Z generation might seem like a daunting task, but banks that wish to remain competitive will have to do it. Otherwise, they risk becoming irrelevant to a market segment whose influence will continue to grow in the years to come.