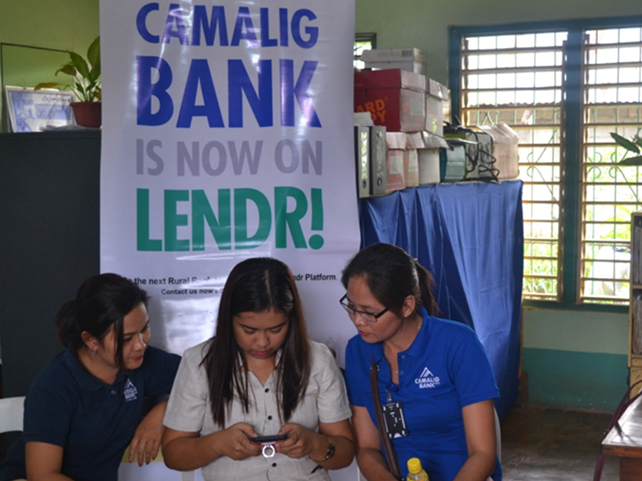

The Camalig Bank, Inc. (A Rural Bank), together with FINTQ, the financial technology arm of PLDT and Smart’s Voyager Innovations, started rolling out mobile-based loan applications to towns in Catanduanes through the digital lending platform Lendr. With the help of Lendr, qualified teachers in various schools in the towns of Viga, Panganiban, and Bagamanoc in Catanduanes were able to apply for loans using Internet-connected mobile devices, and get notifications for their application all within the same day.

Several other schools in the region are also expected to be part of the program in the coming months.

Typically, teachers would have to take a leave from school work just to be able to apply for a loan at bank branches located in Virac, Catanduanes. The trip usually takes them at least two hours one way, with most traveling as much as 57 kilometers just to reach the town proper whenever they need a loan. But through Lendr, teachers and school staff from the Department of Education and instructors and non-teaching personnel from state colleges and universities can now easily apply for a salary loan from Camalig Bank using only their mobile phones.

“The digital age has ushered so much convenience for all. Part of our transformation efforts at Camalig Bank is to bring such benefits to our clientele in the Bicol region, and to be able to serve more clients, even those in far-flung municipalities that are traditionally out of our reach,” said Miel Moralada, president of Camalig Bank.

Camalig Bank is the largest rural bank in the Bicol region, with presence in the provinces of Albay, Camarines Sur, Camarines Norte, Masbate, and Sorsogon, aside from Catanduanes.

The partnership between FINTQ and Camalig Bank through Lendr forms part of the support for the Bangko Sentral ng Pilipinas’ (BSP) National Strategy for Financial Inclusion, which aims to establish programs and system that ensure access to financial products and services for the traditionally unbanked and underserved communities in the country. At the heart of these financial inclusion efforts are mobile and digital systems like Lendr, which enable banks and financial institutions to serve traditionally untapped markets even without establishing brick-and-mortar branches in these areas.

“BSP welcomes this development in starting the journey towards digitizing rural bank lending. This is well aligned with the government’s thrust of promoting responsive and responsible banking. Ultimately, technology will not just level the playing field, but also will bring speed, convenience, cost efficiencies and transparency benefitting customers,” said BSP Deputy Governor Nestor A. Espenilla, Jr.

In 2016, FINTQ’s various digital lending platforms–which include Lendr, LANDBANK Mobile Loan Saver, and micro-lending Pera Agad–have disbursed over P10 billion in loans to more than 110,000 borrowers, 70% of whom reside outside Metro Manila.

To know more about Lendr, visit www.lendr.com.ph. For more information about Camalig Bank, log on to www.camaligbank.com.ph.